Bi weekly mortgage calculator with additional payments

The goal for anyone looking to make additional payments on their mortgage should be paying down as much of the principal as possible. At this point the Mortgage APR Calculator will show the monthly payment for the loan amount term and interest rate you have entered.

Extra Payment Mortgage Calculator For Excel

Finding the Extra Funds.

. This calculator is pretty straightforward. The table below compares monthly payments bi-weekly payments and weekly payments for a mortgages total cost of interest for a 25-year amortization at a 2 mortgage rate. When most people buy homes using mortgage loans they make monthly payments.

Extra Mortgage Payment Calculator 47. Tens of thousands of dollars can be saved by making bi-weekly mortgage payments and enables the homeowner to pay off the mortgage almost eight years early with a savings of 23 of 30 of total interest costs. This additional amount accelerates your loan payoff by going directly against your loans principal.

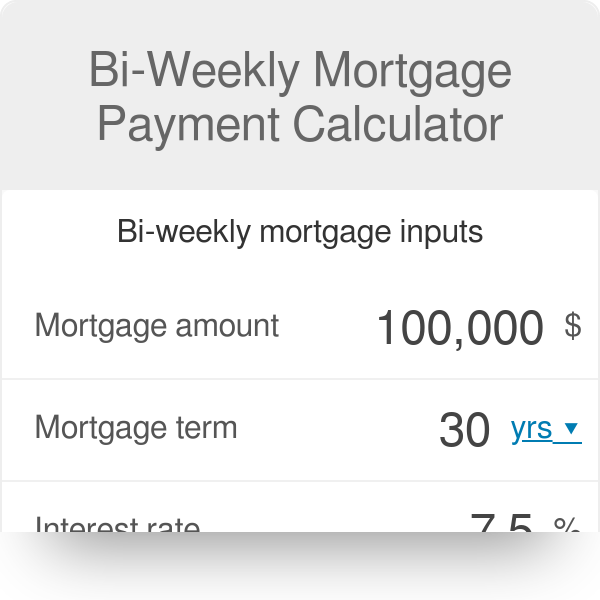

Using the Bi-weekly Payments for an Auto Loan Calculator. The calculator below also accounts for other homeownership costs such as real estate taxes homeowners. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies.

To illustrate how bi-weekly payments work lets compare it with monthly payments. Notice there is a big difference between paying twice a month and bi-weekly payments. Make more frequent payments.

Payments are made every two weeks not just twice a month which results in an extra mortgage payment each year. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Most home loans are structred as 30-year loans which is 360 monthy payments.

There are 52 weeks in a year which means there are 26 biweekly periods. The accelerated weekly payment is calculated by dividing your monthly payment by four. Are you starting biweekly payments in a middle of a loan schedule.

Making payments every other week and being prepared for that occasional extra payment can be good financial discipline and eventually free up your money for other purposes. How Do Bi-Weekly Payments Work. Mortgage loan basics Basic concepts and legal regulation.

That extra payment goes toward the principal of the. Others can use the bi-weekly payment approach as well. Winning with Bi-Weekly Payments.

If you make one entire additional mortgage payment per year with a bi-weekly payment schedule it will take twelve years. With the bi-weekly mortgage plan each year one additional mortgage payment is made. Interest The percentage rate charged for borrowing money.

Then choose one of the three options for enteringcalculating the number of mortgage payments made leave two of the options blank and click the Calculate Mortgage Balance button to return your current balance loan payoff amount. If you pay half of your monthly payment 26 times a year its equivalent to making 13 monthly payments. This allows you to calculate added payments on your preferred schedule.

This is comparable to 13 monthly payments a year which can result in faster payoff and lower overall interest costs. A 20-year loan is 240 monthly payments A 15-year loan is 180 monthly payments a 10-year loan is 120-monthly payments and 5 year loan is 60 monthly payments. A biweekly mortgage payment schedule makes a payment on your mortgage every two weeks instead of once a month.

Plus nothing prevents you from combining bi. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. Adding Subtracting Time.

Three Main Floor Bedrooms With Large Closets And Large Windows With An Amazing View. 9 Ceilings In The Basement With Additional 1400 Plus Square Feet. The total amount paid per year is the same.

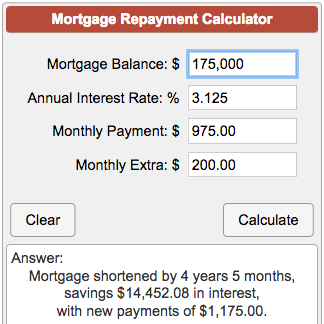

To learn more about other types of extra payments visit the extra payment mortgage calculator. Bi-Weekly Mortgage Payment Calculator Terms Definitions. Using our calculator above you can estimate the savings difference conveniently.

Different Strategies to Make Additional Payments. Steps To Curley Lake. Choose Annually or Monthly for Report Amortization This will not affect your results on this page but will determine how your amortization schedule will be shown on the following page after you click.

You can use your current lender to switch to biweekly payments or create a schedule yourself. 26 bi-weekly payments of 977 will result in roughly 25400 being paid in a year. Make sure you look for mortgage scams and check with your lender to make sure it supports biweekly payments and credits you appropriately.

Bi-weekly payments are another way to create the equivalent of a 13th month payment. Mortgage Loan The charging of real property by a debtor to a creditor as security for a debt. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest.

The amount of time saved on the current loan schedule by making additional payments toward the principal mortgage balance. Our Canadian Mortgage Calculator allows you to calculate your monthly mortgage payments and cash needed for the purchase of real estate using current lender rates. Whatever the frequency your future self will thank you.

For your convenience current Redmond mortgage rates are published underneath the calculator to help you make accurate calculations reflecting current market conditions. In making biweekly payments those 26 annual payments effectively create an additional 13th month of regular payments in each calendar year. Enter the mortgage principal annual interest rate APR loan term in years and the monthly payment.

Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. It could be one extra mortgage payment a year two extra mortgage payments a year or an extra payment every few months. Bi-Weekly payments are mortgages that are paid every other week and the payment is half of the monthly payment.

Maintain these additional payments over an extended period of time and youll likely eliminate several years from your term. With bi-weekly payments you pay half of the monthly mortgage payment every 2 weeks rather than the full balance once a month. Our calculator above can estimate other payment schedules such as weekly quarterly and annual payments.

One of the most common ways that people pay extra toward their mortgages is to make bi-weekly mortgage payments. The effect can save you thousands of dollars in interest and take years off of your mortgage. Aside from adding an amount to monthly payments there are other ways to make extra payments to your mortgage.

Given that there are 12 months and 52 weeks in a year paying 26 bi-weekly payments is like paying 13 monthly payments with the 13th payment going entirely toward the principal of the loan. Bi-Weeklies True bi-weekly payment calculator Prints yearly amortization tables. Bi-weekly payments are another popular way to pay extra on a mortgage.

Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance. This once-a-month option is common and its convenient as these payments are made on the same day each month. There are 26 bi-weekly periods in the year but making only two payments a month would result in 24 payments.

Private mortgage insurance PMI you made a 20 down payment worth 65000. You would then make 52 weekly payments. Bi-Weekly Payments Payments that occur once every two weeks.

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. Principal Amount The total amount borrowed from the lender.

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Calculator For Extra Payments Hotsell 50 Off Www Wtashows Com

Biweekly Mortgage Calculator How Much Will You Save

Biweekly Mortgage Calculator

Downloadable Free Mortgage Calculator Tool

Downloadable Free Mortgage Calculator Tool

Mortgage Calculator For Extra Payments Hotsell 50 Off Www Wtashows Com

Biweekly Mortgage Calculator With Extra Payments Free Excel Template Excel Templates Mortgage Payment Calculator Mortgage

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Mortgage Calculator For Extra Payments Hotsell 50 Off Www Wtashows Com

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Bi Weekly Mortgage Payment Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator How Much Will You Save

Biweekly Mortgage Calculator How Much Will You Save

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template